M&A is notoriously difficult to get right, but increasingly is still the best option to seize opportunities by scaling up. It’s not just why and where to acquire but how that matters. Here are a few pointers to help you get your acquisition approach right.

Every year, hitherto sleepy industries erupt into a frenzy of corporate acquisition activity as intensifying competition, new entrants and established incumbents act to protect or enhance their markets and margins.

The triggers for M&A are rarely a single event – such as regulatory change – but typically a ‘perfect storm’ of combined factors, from supply chain costs and skills shortages to technology disruption and customer diversification.

In other cases, acquisitions are driven by professional investors realising the depth of opportunity in an ‘old fashioned’ marketplace – as seen in the ongoing consolidation of vets and dentists.

As merger-mania reshapes whole industries, egos, vanity and fear-of-missing-out can creep into decision-making – regularly resulting in overpaying for targets, boardroom unrest, and an unwieldy corporate structure.

Are acquisitions risky?

Around 50-60% of all M&A transactions fail shortly after completion, according to research by Harvard Business Review and Mckinsey. This is destructive both for the acquired company and the acquirer/sponsor.

The most common failure is a lack of long-term thinking – management sees the transaction ‘structure’ as the focal point in M&A, while not paying enough attention to integrating the target company into the group. This approach often leads to a loss of synergy benefits, management time wasted trying to fix emerging issues, and of course the value from the transaction. M&A can be highly diversionary!

3 ways to ensure acquisition success

Broadly there are three M&A strategies you should consider:

Programmatic

Regular purchase of small acquisitions

- Ensure that each transaction fits within your own growth strategy. Each target should solve some scarcity problem within your own business to address your strategic goals. These transactions are planned, strategised and organised to complete within a defined timeframe

- Programmatic M&A ensures the allocation of management time to post-integration work, as ‘bite-size’ tasks that can be integrated and value derived

- The downside of this approach is that it takes more management time in the early stages, and it depends on the business having a fully evolved commercial strategy already in place.Tip: CapEQ is highly successful at helping companies develop and deliver programmatic M&A using a research-led methodology and transactional framework for success. We deliver M&A pipelines for many of the UK’s mid-size and smaller PLCs.

Transformative

Small number of large acquisitions

- Where you undertake very few, but very large transactions with the goal to comprehensively transform the future of the business

- These targets offer the quickest upsides but carry significant risk- transformative M&A is by far the hardest transaction to deliver and integrate successfully. The acquirer must not only integrate IT, financials and contracts, but also somehow marry culture and working practices

- Transformative transactions have the highest failure rate of all M&A over the medium and long term. They rarely value accretive to shareholders – although when it works, it adds significant value – and executives are often enticed by generating attractive headlines about them personally. Large egos often drive these types of transactions, but remember: acquisitions should only be made on an commercial basis.

Opportunistic

Occasional unplanned acquisitions

- These are the most common form of acquisition. Buyers either spot an opportunity, or are approached (often by an intermediary). They can potentially be highly successful as there is always a chance of a gem turning up

- Random pursuit of targets can be chaotic for management teams, as the transactions aren’t planned, management time is rarely available ‘on tap’. Understanding the true accretive value is also tricky as there is often limited time to fully asses the opportunity. Of course its also the most unreliable of M&A strategies as you have no control over when transactions will take place.

What’s the best route for you?%22%20transform%3D%22translate(.9%20.9)%20scale(1.75781)%22%20fill-opacity%3D%22.5%22%3E%3Cellipse%20fill%3D%22%230b4f38%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(-89.5%20146.4%2045)%20scale(23.94115%20218.57215)%22%2F%3E%3Cellipse%20fill%3D%22%2387cbb4%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(254.97514%203.56036%20-.71501%2051.20585%20113.4%2094.3)%22%2F%3E%3Cellipse%20fill%3D%22%230d513a%22%20cx%3D%22134%22%20cy%3D%226%22%20rx%3D%22255%22%20ry%3D%228%22%2F%3E%3Cellipse%20fill%3D%22%23488d75%22%20cx%3D%22189%22%20cy%3D%2229%22%20rx%3D%22211%22%20ry%3D%2221%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

While no acquisition is risk-free, most risks can be mitigated with some careful planning beforehand.

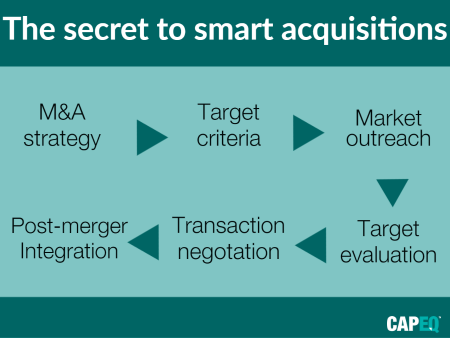

Addressing the why and where naturally leads to how to acquire, from setting target criteria and structuring your final offer to handling post-deal integration issues.

A rapid acquisition spree regularly causes some emerging challengers to implode, while buying too small or infrequently is unlikely to shift the dial on overall corporate performance. Success in acquisitions depends on boardrooms and in-house M&A executives working with impartial corporate finance advisors to clarify priorities, assess risk appetite, and plan integration.

Contact one of CapEQ’s senior advisors for an exploratory discussion on your acquisition aspirations. We can help.