Business sale timescales vary significantly depending on the complexity of the company and the strength of market interest. Here’s what you can expect from a well-run acquisition process.

You can probably guess the answer – selling a business takes as long as it takes.

At one extreme, a business sale process can complete in a matter of weeks, or take 18+ months. However, most business owners can expect to shake on a deal within 6-9 months.

Clearly, the more complex the enterprise, the more time it will take. If you end up selling your business to an international buyer, the added complexities of multiple legal jurisdictions, currency exchange rates, and intellectual property takes longer than a straightforward business sale to a UK ‘trade’ buyer.

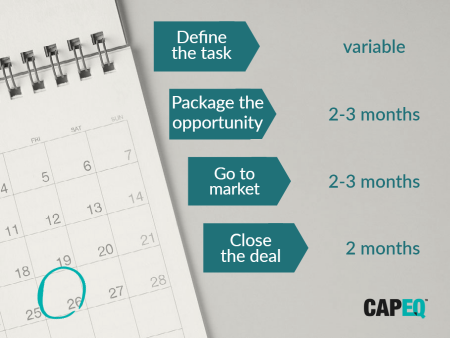

Four steps of selling a business

Typically, you should allow 2-3 months to agree the process with your advisor, prepare your proposition, create a prospectus and do your internal due diligence.

Then add another 2-3 months to launch your marketing and find potential buyers/investors, reaching each with attractive messaging up to ten times to whet their appetites.

If all goes well you will uncover more than one serious suitor. Whether you are being courted by one or many potential buyers/investors, it will take an additional few months to complete negotiations.

This is often summed up as a four-stage process:

- Define the task

- Package the business

- Go to market

- Close the deal

%27%20fill-opacity%3D%27.5%27%3E%3Cellipse%20fill%3D%22%23629483%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(161.9%20100.6%2077.1)%20scale(68.65961%20161.91724)%22%2F%3E%3Cellipse%20fill%3D%22%23fff8fa%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(-17.9%20934.8%20-114)%20scale(90.05546%20347.91397)%22%2F%3E%3Cellipse%20fill%3D%22%235ac19d%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(22.93272%20105.17894%20-36.93168%208.0524%20220.4%20138.7)%22%2F%3E%3Cellipse%20fill%3D%22%23b6afb1%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-1.52698%20-20.36191%2096.06457%20-7.20407%2078%2052.9)%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

As a rule of thumb, you can navigate all four steps involved in selling a business in the UK within six months, but it is more realistic to allow nine – and in more complex instances, involving selling your business to an international company, around a year.

Controlling your business sale timetable

That said, it is amazing what can be accomplished when circumstances demand an expedited approach.

We completed one business sale just over four weeks from first being approached. Corners were cut and we would not recommend this compressed timeframe, but our client was facing exceptional circumstances – around an exclusivity deal with a supplier – which made it essential to complete before an imminent deadline.

Of course, there is no guarantee of selling your business. The numbers may not add up to everyone’s satisfaction; negotiations may fail due to disagreements, personality issues or technicalities; or people simply change their minds.

More positively, some of our best experiences have entailed pulling back from a proposed disposal, or rejecting an initial approach. Often this is because additional time is needed to take a more potent proposition to market.

Rushing headlong into a business sale can often be a bad idea, so we always counsel against having fixed views or an inflexible plan. With exceptions (such as the rapid turnaround cited above), there is rarely an absolute imperative to get the deal done within a particular timescale.

A preferable approach is to move as fast as possible, but no faster than necessary.

In a few cases we have worked with clients who treated a first attempt to sell as an exploratory exercise, deeming the time or deal to be wrong. We have then returned a year or two later, finding that the second attempt is marked by much better data, upgraded internal processes and greater clarity of intent.

Tip: Read How to handle an unexpected offer for your business

Get professional advice from an M&A specialist

The guiding principle, therefore, is to take things at a measured pace. It is tempting to ask how to sell a business quickly, but moving on from any company works best when you follow best practice, not a stopwatch.

Get your M&A advisors involved early, to map out the territory and the road ahead, based on relaxed discussions about your needs and priorities. This gives you time and space to prepare for the sale.

You might then spend months optimising your operations, overhauling your documented processes and procedures or adjusting headcount/investment plans.

It is highly unlikely that you are already presenting your best face to suitors (most of us shamble along, only changing clothes and scrubbing up before a hot date). As noted, it is good practice to stay in good shape if you can. Taking your time gives you the opportunity to look sharp.

Whilst you are doing this, your advisors can conduct a more comprehensive market assessment, built around your individual requirements.

By avoiding a rushed transaction, many of the inevitable stresses of a business sale can be minimised. Price is always going to be of fundamental importance, so the more time you have available to maximise your value and justify your asking price, the better.

However, a sale is rarely just about the price – and certainly not when you use a B-Corp ethical advisor like CapEQ. Taking a pause gives you the chance to consider and prepare for CSR aspects of a sale, ensuring that your environmental, HR and legal frameworks face up to scrutiny. If you attract multiple suitors, this is when you can detect like-minded prospective buyers, ensuring a cultural and philosophical fit, not just someone with a bucketload of cash.

Open-ended business exits

Not being constrained by a fixed initial date also gives you time to think. You will be hard at work running your business during the sale, so will have little or no time to rest and ruminate. If that is true right now, why would you get a chunk of downtime just as you fatten up for your business exit? The likelihood is that you will be working twice as much and four times as hard.

You are going to need every minute you can reclaim to talk to advisors, family and friends – then find a quiet moment to ask whether progress is still aligned with your business and life goals. Planning creates the time and opportunity.

Changing your mind during a business sale

This is of fundamental importance. There is no value in time if you use it to vacillate or change direction arbitrarily. You need to take time up front to nail down a clear understanding of the outcome you want to achieve.

It’s surprisingly common for founding business owners to question their own decision to sell, especially when bidders are enthusing over your latest product or distribution platform.

Notwithstanding that, circumstances will change and agreements will get tweaked as the transaction progresses. You will need to carve out time to check that you remain on track. You will also need to commit energy and time to staying there, ensuring that distractions and changes don’t lead you away from the straight and narrow.

While a poor guide will fixate on process and speed, a good advisor will understand and support your need to reflect and coordinate the timing of various stages accordingly. They should act as an objective counsellor, putting your needs before their need to complete a deal – even a bad one.

Yes, they may provide a firm hand on the steering wheel or have contrary opinions based on hard-won experience, but their first duty is to you.

So when considering how long it takes to sell your business, unless there is a very good reason, always take your time – to do it right.