Knowing when to sell your business helps you get your ducks in a row and take everyone with you on the same journey when the time comes.

Knowing the right time to sell your business

You’re considering a sale. It’s exciting. Worrying. Challenging.

It throws up a lot of questions, including: ‘What?’ ‘Why?’ ‘How?’ ‘To whom?’ And ‘When?’

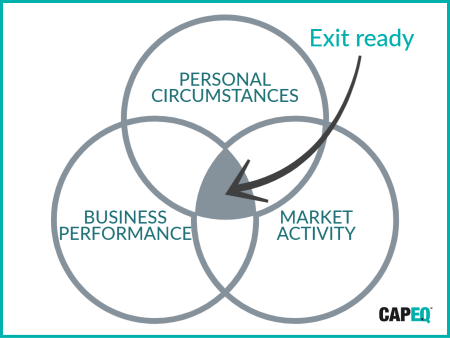

Whatever business you’re in, when to sell (and all the steps to selling) depends on the alignment of three ‘planets’:

- the business to be in good shape

- you feeling ready to change yourself

- the market moving in your favour

The first two are relatively straightforward. There is no good reason not to maintain your company in a constant state of readiness for a business sale. Equally, you can always make time for yourself, thinking and planning ahead for retirement or a new challenge.

Controlling the third planet – the market – lies beyond you, but as Meatloaf pointed out so poignantly, ‘two out of three ain’t bad’.

So here’s how to sell – moving the planets into line.

Getting your business ready for sale

If you already run an efficient SME, your books will likely be accurate and up to date, your processes well-documented and your management records will be meticulous. You will have a proper business plan, cashflow and resilience back-up in place.

Staying on top of record-keeping and strategy ensures that you have everything to hand for demonstrate to external parties a well-run and transparent business – critical for when planets two and three line up behind you.

The reality however is that most owners don’t plan like this, and you need to get everything ready as if you were due to sell tomorrow.

Start simple. Gather your ‘foundation documents’ – articles of association, liability insurance, shareholder agreement. Then move onto leases, policies, contracts, supplier agreements etc.

With your management information in optimum shape, you will be ready to respond efficiently to an unexpected acquisition approach or to set you up for a planned major shareholder exit.

Planning for life after selling a business

At the same time, you need to get your head straight, wrapping your brain around the idea of achieving other life goals.

The chances are that you don’t see your enterprise as merely a money-making machine. It’s your pride and joy. You built it.

You have invested your talent and passion, taken risks, and invested significant money and time. Chances are you are highly emotionally invested – moving on is not just a rational decision. You need to spend time working out what you will do next.

This change is hard at the best of times, and especially so if your business exit is unplanned – forced upon you by personal circumstances, market conditions, or financial performance. You’re not in control, emotions may cloud your judgment over the biggest financial decision of your life.

Therefore, your second practical step is to understand the emotional impact of ‘life after sale’. This will frame how and when to sell your business.

- Do you plan to retire and perhaps move house or country?

- Could you develop other business interests to stay active?

- How will your sudden wealth affect family relations and friendships?

Whatever the next chapter holds, it’s worth speaking to a wealth advisor at this point to help you organise your future.

Of course, this exercise may lead you to realise you are a ‘work until you drop’ type and never want to sell. Does anyone even know that? Family, colleagues and suitors?

Identifying potential acquirers for your business

Waiting for peak market conditions to sell your business is undoubtedly the trickiest of the three planets.

Have some of your competitors sold up recently? Who are the major acquirers? What price/terms are similar SMEs changing hands for? What business metrics do acquirers use to qualify target acquisitions?

If this is hard to find yourself, approach a business sale advisor for a free review of M&A market conditions in your industry.

You will never be able to predict the market or economy with total accuracy. However, a few key insights into M&A activity and trends will give you a strong sense of whether your business will be attractive to acquirers, and who may be interested.

Tip: Remember it typically takes 12+ months to sell a business and market conditions can change rapidly.

Prepare for the unexpected offer

Setting clear criteria for a business sale will also make you better at responding to unsolicited offers, which can be a real banana skin for business owners.

Not being prepared for such approaches can be particularly damaging. Even if welcomed, pulling together lots of sensitive information at short notice is not only time-consuming but risky.

Unexpected acquisition offers also risk shareholder disputes. One might be keen to sell and buy a yacht. Another has fixed views about an acceptable price. A third may not want to sell at all.

A good M&A advisor will be able to buy you time while you iron out your exit aspirations, as well as assess the offer price.

Prep now is time saved later

Getting you and your business ‘exit-ready’ makes total sense, and yet so few business owners bother. Why?

Here’s what we commonly hear

“I meant to do it but I got pulled into something else.”

“The business isn’t worth enough right now. I need to grow it more before I go about selling it.”

“I don’t want to work for a new owner”

“If someone wants to buy my business, they’ll come to me.”

“This is my life. What else would I do?”

The bigger truth here is that setting out a timeline for the sale of your business doesn’t add to your workload – it reduces it. You are replacing evasion with clarity. Active management beats crisis management every time.

Final word: plans make profits

One of our clients was the sole shareholder in his business. He met the Managing Director monthly. Together they ensured all data was kept up to date. When a sale became possible, the availability of accurate records demonstrated competence. It instilled confidence and encouraged a generous offer.

Conversely, another client produced his accounts on handwritten sheets of A4. This was harder for us to help…he was in no position to sell at a premium.

Planning ahead also prepares you for both an unsolicited approach or change in business/personal circumstances.

Conclusion: Always be ready to sell – even when you have no intention of doing so.