Shareholder disagreements are one of the most challenging and disruptive aspects of running a business. Whether it's a dispute over company direction, dividends, or decision-making authority, these conflicts can undermine business performance, damage relationships, and even lead to legal battles or business collapse.

To avoid such shareholder bust-ups, it's crucial for business owners and shareholders to understand the common triggers of disputes and implement strategies to manage and prevent them effectively.

In this comprehensive guide, we’ll explore practical tips on how to avoid shareholder disputes and maintain harmonious working relationships. We will cover topics including clear agreements, open communication, decision-making frameworks, and conflict resolution strategies.

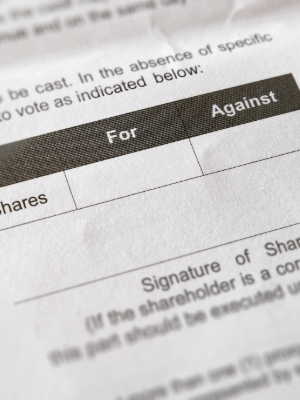

Revising Shareholder Agreements

A well-drafted shareholders’ agreement is the foundation of any successful business partnership. This document outlines the rights, responsibilities, and obligations of shareholders, helping to prevent misunderstandings and conflicts later on.

Here are key elements that should be included in a shareholders’ agreement:

Roles and responsibilities

Define the roles of each shareholder within the company. Clarifying the duties, decision-making authority, and areas of responsibility will reduce friction, especially in day-to-day operations. For example, one shareholder might oversee sales and marketing, while another focuses on financial management.

Profit distribution

Outline the policy for profit distribution, including dividends and reinvestment in the business. Disagreements over how and when profits are distributed can quickly escalate into disputes. By setting clear rules from the outset, you can prevent these issues.

Decision-making processes

Establish how major decisions will be made. Will decisions be based on a simple majority vote, or will certain actions (e.g., selling the company, changing business strategy) require unanimous consent? The more clarity you provide on decision-making processes, the easier it will be to avoid disputes later.

Dispute resolution mechanisms

No matter how well you plan, disagreements may still arise. Including a dispute resolution clause in your shareholders' agreement is critical. This clause should outline how disputes will be handled, whether through mediation, arbitration, or another mechanism, before resorting to legal action.

Tip: Ensure that the shareholders' agreement is regularly updated as the company grows and evolves. Businesses change over time, and agreements must adapt accordingly.

Encourage open and transparent communication

One of the primary causes of shareholder disputes is poor communication. Without open channels for discussion, misunderstandings can fester and escalate into significant conflicts. Effective communication practices can foster trust and prevent bust-ups.

Clarify ownership and voting rights

In many shareholder disputes, disagreements arise over who has the authority to make certain decisions or how ownership is divided. Clarifying these matters upfront can prevent significant conflicts down the line.Equal vs unequal shareholdings

Not all shareholders may hold equal shares in the company, which can complicate decision-making. It’s important to clearly outline the percentage of ownership and how this translates into voting rights. In some cases, majority shareholders might have more influence over key decisions, which needs to be accepted and understood by minority shareholders.

Good leaver vs bad leaver: how exit provisions shape shareholder payouts

Good leaver/bad leaver provisions regulate the price a shareholder receives upon exit, typically favoring good leavers with full market value while heavily discounting bad leavers' shares. Although the discount may seem harsh, recent case law (Moxon v Litchfield) confirms that well-drafted provisions are enforceable. Shareholder agreements, which are distinct from employment contracts, often trigger bad leaver events when a shareholder-employee ceases to be employed. This ensures that shareholders who breach employment obligations don’t benefit from company value increases. Therefore, both shareholder agreements and employment contracts must be carefully drafted to align expectations and protect co-shareholders' interests.

Reserved matters

Identify reserved matters—specific issues that require shareholder approval, regardless of shareholding percentage. This could include decisions like issuing new shares, selling significant assets, or taking on large amounts of debt. Reserved matters ensure that minority shareholders have a say in critical decisions, reducing the likelihood of feeling sidelined.

Shareholder classes

For more complex businesses, different classes of shares can be issued to shareholders, each with varying rights. Some shareholders may have voting rights, while others might have preferential treatment for dividends. By defining these classes clearly, businesses can prevent disputes over who holds decision-making power.

Appointing independent directors

In some cases, appointing independent directors to the board can help resolve conflicts of interest. Independent directors, who have no stake in the company, can provide impartial advice and oversight in situations where shareholder interests may clash.

Tip: Regularly review potential conflicts of interest as the company grows and shareholders’ personal situations evolve.

Establish minority share buyouts and share transfer rules

Shareholder disputes often arise when a shareholder wants to exit the business, or when there are disagreements over bringing in new shareholders. Without clear exit strategies and share transfer rules, these situations can lead to prolonged and costly battles.

Buy-sell agreements

A buy-sell agreement outlines the process for buying or selling shares in the company. This agreement should cover scenarios such as the death, retirement, or voluntary exit of a shareholder. By clearly defining how shares can be transferred and at what value, businesses can prevent disputes during these transitional moments.

Pre-emption rights

Including pre-emption rights in the shareholders' agreement ensures that existing shareholders have the right to purchase shares before they are offered to external parties. This prevents unwanted outsiders from gaining control of the company and gives current shareholders a sense of security.

Share valuation

Disagreements over the valuation of shares are a common cause of bust-ups, especially when a shareholder exits the business. To avoid this, outline a clear and fair method for valuing shares, whether through independent valuation or a pre-agreed formula.

Voting thresholds

Define voting thresholds for different types of decisions. For example, routine business decisions might only require a simple majority vote, while significant changes, like altering the company’s structure, could require a supermajority (e.g., 75% of votes). This structure helps prevent deadlocks and ensures that all shareholders are clear on how decisions will be made.

Tie-breaker mechanisms

Deadlock situations can occur when shareholders are evenly split on a critical decision. To prevent this from escalating into a bust-up, include a tie-breaker mechanism in your decision-making framework. This could involve appointing an independent advisor to cast the deciding vote or deferring the decision to a specific board member.

Board vs. shareholder decisions

Clarify which decisions can be made by the board of directors and which require shareholder approval. Having this division of responsibilities ensures that operational decisions are not bogged down by shareholder disagreements, while strategic issues receive the necessary shareholder input.

Information rights

The main documents of interest to shareholders will be the company's annual report and accounts. Each shareholder has the right to receive these when they're issued, and on request. Shareholders also have the right to receive a copy of any written resolution proposed by either the directors or shareholders

Seek professional mediation or arbitration early

Despite the best efforts, shareholder disputes can still arise. When conflicts reach an impasse, seeking professional mediation or arbitration early can prevent the situation from escalating into costly legal battles.

Mediation

In mediation, a neutral third-party mediator helps facilitate a resolution between shareholders. Mediation is typically faster and less expensive than litigation and can help preserve business relationships by fostering cooperative dialogue.

Arbitration

If mediation fails, arbitration provides a more formal dispute resolution process. In arbitration, an independent arbitrator hears both sides of the dispute and makes a binding decision. This process is often faster and more cost-effective than going to court.

Removing a troublesome shareholder

Removing a director from a company can be a strategic move in shareholder disputes, particularly when directors are also shareholders. While this action might seem like a quick solution to problems within the business, it’s often complicated by the company’s Articles of Association and any existing shareholder agreements. These documents may grant contractual rights to board positions, which must be carefully considered before proceeding with the director's removal.

The process of removing a director typically involves calling a general meeting, where the majority shareholders can pass an ordinary resolution to remove the director. The director must receive special notice and be allowed to make representations. However, the procedure can vary based on governing documents, and following the correct legal steps is crucial to avoid potential claims of procedural breach. It’s also important to note that removing a director from the board does not affect their status as an employee, which requires a separate termination process to avoid unfair dismissal claims.

Even after removal as a director, the individual may remain a shareholder with voting rights and entitlement to dividends.

Conclusion

Avoiding shareholder bust-ups is essential to maintaining the smooth operation and long-term success of your business. However, unresolved conflicts can and do derail M&A negotiations.

By creating clear agreements, fostering open communication, managing conflicts of interest, and implementing robust decision-making and dispute resolution frameworks, you can head off shareholder challenges before the formal sale process begins.

No one selling a business wants to be buying out minority shares in the middle of due diligence demands.

Caution: This article is for general advice and does not constitute legal or professional advice. If you have a challenging shareholder issue to discuss, get in touch and we can recommend several high quality law firms to help you get all your ducks in a row for a business sale.