In today’s rapidly evolving business landscape, mergers and acquisitions are emerging as a vital strategic lever to navigate for CEOs to navigate the seismic shifts in technology, sustainability, and consumer demands.

Although the number of companies changing hands fell 27% in 2023 – a steeper decline than the pandemic year of 2020 – recent indicators suggest a return to optimism.

Durability of acquisitions

- European M&A activity surged in Q4 2023 by 60% on the previous quarter, with average deal sizes jumping 63%.

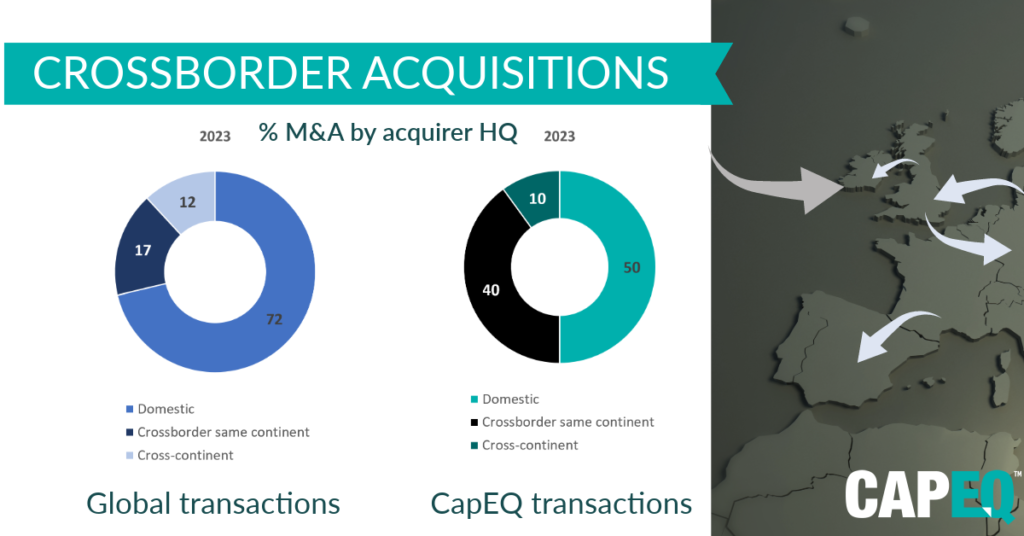

- Crossborder acquisitions rose to 29% of all M&A – a five-year high and following a clear upward trend.

- Job growth and consumer spending remain robust in US and EMEA regions

- Analysts are forecasting average 5% revenue growth and EBITDA margins of 8-9% this year

- Energy and materials M&A was the most active sector – toppling tech, media and telecoms (TMT) – and accounting for 26% of global deal value

However, a return to buoyant M&A market seen in pre-pandemic years is likely to be tempered by a few negative factors

- Geopolitical instability – the Ukraine war, Middle East tensions, and sabre-rattling between major powers is leading multinational CEOs to think more about protecting supply chains, and moving from international expansion to localisation

- There are elections in 60 countries this year, creating an uncertain policy outlook

- Regulatory decisions into acquisitions are taking 35% longer than 10 years ago – rising to 50% in Europe

- Investor participation in M&A has fallen 37% globally in 2023, after private equity and venture capital retreated as the cost of capital from interest rate rises subdued appetite

- Inflation has fallen to around 3% in US and eurozone, offering improved certainty in financial forecasting and pricing stability

For acquirers, the seismic shifts in consumer behaviour, competitor intensity, and customer demands requires agile strategies with M&A as a key component.

Market drivers for M&A in 2024

- Shareholder dividends – large corporations who make multiple SME acquisitions every year tend to offer superior shareholder value

- Supply chain resilience – global supply chain disruption is motivating CEOs to vertically integrate markets. This is already prevalent among big UK insurers

- Solvency risks – linked to supply chain resilience, volatile sectors like construction are seeing an uptick in acquisitions of struggling suppliers to protect building pipelines

- Transformational synergies – emerging technologies (eg AI) are influencing CEOs to augment their core offer with complementary acquisitions. Popular with martech/adtech

- Consumer behaviour – tech-driven societal changes are rapidly changing market behaviour from product category shifts online to longer-term lifestyle changes – e.g. teetotalism, home-based entertainment, working from home.

Is it a good time to acquire a business?

Few business owners wake up one day deciding to sell their company. Thinking it through usually takes time, taking in what life will look like after sale, how the business is performing, and current market conditions to achieve the best price and terms, and the right fit.

For acquirers, the seismic shifts in consumer behaviour, competitor intensity, and customer demands requires agile strategies with M&A as a key component.